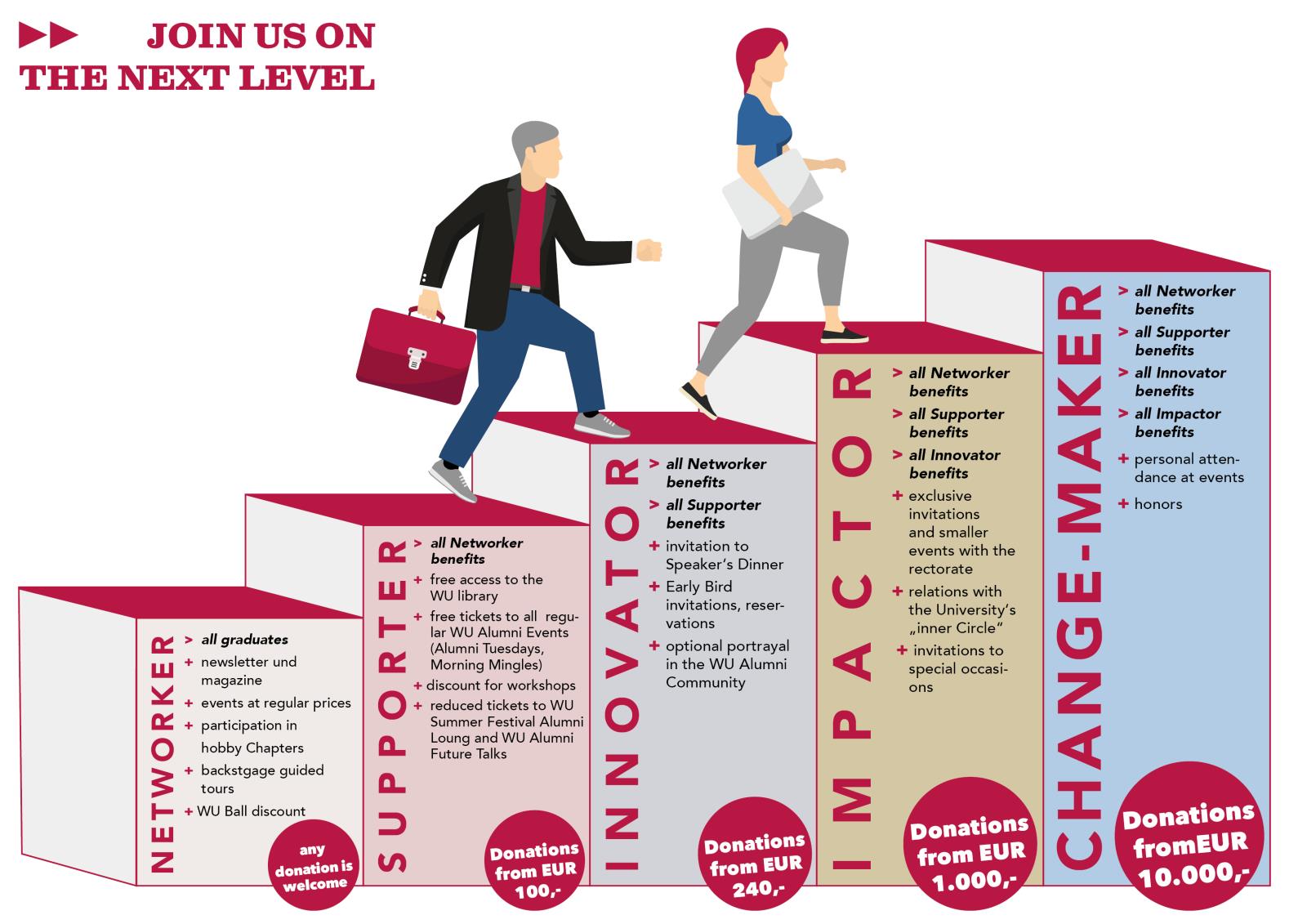

From Networker to Change Maker.

Every graduate is an alumnus or an alumna, regardless of the academic year, degree or training course at the WU. Everyone is part of the WU Alumni Networkers, automatically and free of charge.

In addition, we would be grateful for your meaningful support. Step by step, with your help, the quality of the WU will keep on growing.

Get involved by simply choosing which option suits you best. We welcome every and all forms of support: Each donation will help knowledge growth and ensure our continued excellence.

next-level pdf form

Which type of donation will you choose? It's up to you.

Provide support and attend events

If you wish to take part in WU Alumni events and also make use of WU Alumni Benefits (free or reduced-price access to events), the level of tax deductibility on your donation will be reduced by a small amount. This is because a certain portion is regarded as payment for benefits received. Please note that all WU Alumni events are in German.

to "Support plus"

Support pure

If your contribution is solely in the form of a monetary donation, the entire sum is tax-deductible.

to "Support pure"

Contact

If your contribution is solely a monetary donation, the entire sum is tax-deductible.

to the WU Alumni Office

About Taxes and Cancellations

Your annual donation is paid to the WU via SEPA transfer for as long as you wish. Of course, you can at any time choose to suspend the annual transfer, change the amount or indeed cancel the transaction completely. Just get in touch with the WU Alumni Office for further assistance.